The Case for Buying Dividend Yielding ETFs Inside Super

Disclaimer: None of this is Financial Advice. However, all of this information is available in the Public Domain and is Specific to Australia. Links provided for reference

Australians love Superannuation Funds or Super as they are commonly called here.

As of September 2022, Australians had combined assets of $3.3 Trillion in Super. That’s 3.3 followed by 12 zeroes!

When choosing an investment strategy, it is good to diversify.

Diversification can be across asset classes, countries and also the investment vehicle.

Historically, Australians investments are heavily skewed towards Australian assets. Property is a big one obviously, but even our choice of Shares/ETFs is Australian based even though our share in the global economy is tiny.

While Australia has one of the world’s highest rates of share ownership, the number who invest in global share markets, remains disproportionately low (at around 13%).

- Source

Australian Stocks

Nonetheless, the Aussie love affair with Australian stocks, LICs, ETFs isn’t entirely unfounded.

Historically, Australian shares (and ETFs) pay much higher dividends than their American or International counterparts. Additionally and rather uniquely Australia has a favourable taxation regime when it comes to Dividends.

Companies pay Company tax, therefore Dividends are considered to be post tax and whatever tax the company has paid, is provided as a credit to the receiver: this is known as a Franking Credit. For high rate tax payers this can be very beneficial.

Diversification: If one is deciding on a mix of International and Aussie shares and ETFs in order to diversify and minimise geographical risk, the question then is which vehicle to choose for which market, i.e what do you invest within Super and what outside?

The Case for Super

Here I make the case for choosing Australian shares within Super and International Shares outside of Super. Depending on your allocation and size of holdings, this may work out to be mix of both in each of your holdings, i.e having both in Super and outside. But, I would put a higher proportion of Australian shares within Super.

This is because Australian shares pay higher dividends (around 4%). Remember Franking Credits, which can increase this figure for higher rate tax payers.

But, within Super, Dividends are taxed differently.

Let me illustrate with charts of After Tax Performance of VAS (Vanguard Australian Shares Index ETF) published on their website.

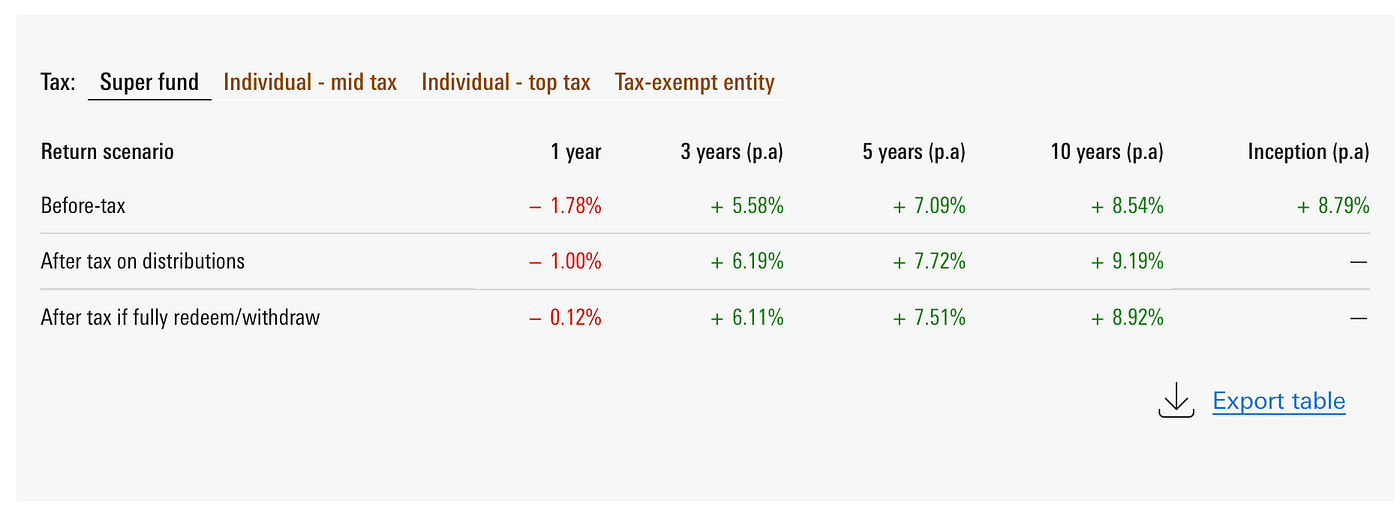

VAS Returns within a Super Wrapper

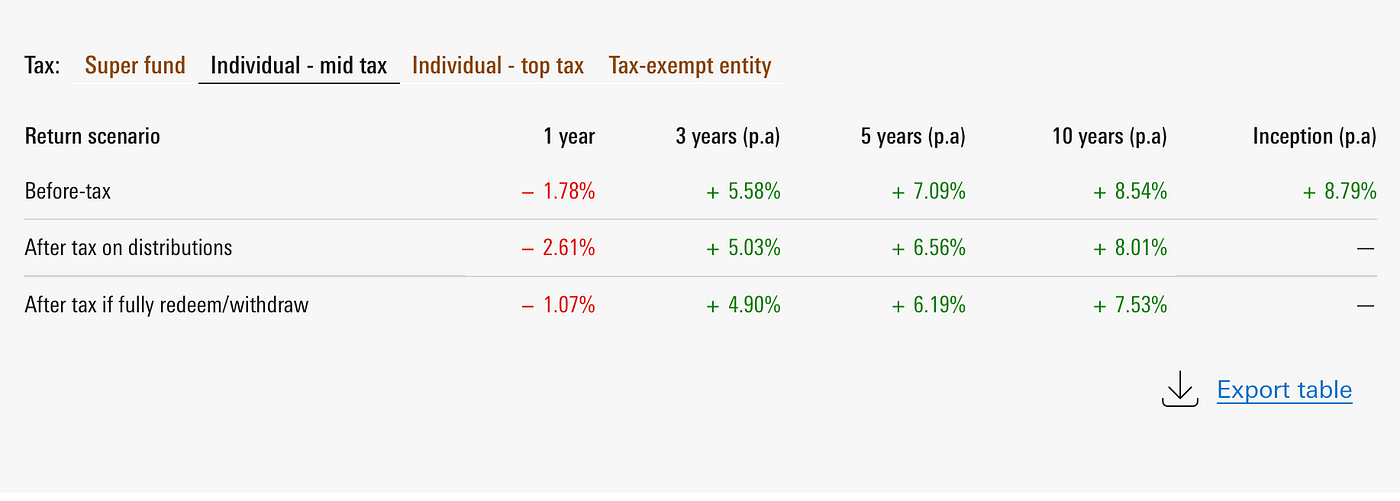

VAS Returns for a Mid tax Individual

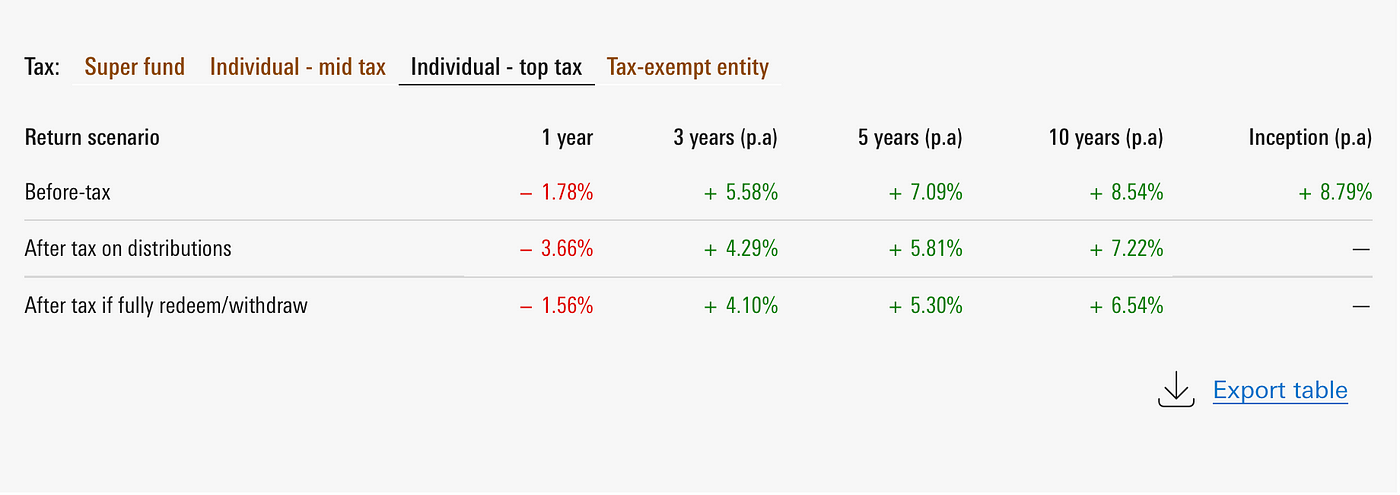

VAS Returns for a Top Tax Payer

Comparisons

Now look at the above 3 charts and for simplicity let’s compare the 10 year returns. The returns for investment after tax on distributions inside super is 9.19%. For a high rate tax payer it is 7.22% and for a mid rate tax payer is 8.01%

According to the Rule of 72, investments for a high rate tax payer would double in roughly 10 years outside Super and in 8 years inside Super.

Even for a Mid Rate tax payer, for an investment to double outside Super would take 9 years.

If you are holding for the long term this could be a giant difference and way more important than the MER of a fund which is what gets all the headlines.

Lets illustrate this with some numbers.

Assume an investment period of 40 years

In 40 years, the money would double 5 times, i.e it would be worth

$1000 x 2⁵ = $32,000

a) High Rate Tax payer, the money doubles 4 times

$1000 x 2⁴ = $16,000

b) Mid Rate Tax Payer, the money doubles every 9 years so roughly 4.5 times

which would be roughly $22,000

Clearly, it makes sense to buy dividend yielding Australian Stocks, LICs, ETFs within Super even before we consider the tax benefits of investing in Super itself

I'll cover this in another episode

Till then...

Recent Posts

| title | Also see | date |

|---|---|---|

| Independent Contractors | March 19, 2023 | |

| 💲 GP Billings | February 16, 2023 | |

| ⛓️ GP Contracts Simplified, Part 2 | February 11, 2023 |